Mastering the Art of Building a Diverse and Lucrative Coin Portfolio: A Step-by-Step Guide for Investment Success

- Charlie Tripodis

- Feb 3

- 4 min read

Creating a coin portfolio involves strategic planning and informed decisions. Whether you're just starting or looking to refine your collection, building a diverse and profitable coin portfolio can lead to lasting success. This guide offers essential steps to help you develop a strong coin portfolio that aligns with your investment goals.

Understanding the Basics of Coin Investment

Understanding the fundamentals of coin investment is crucial for success. Coin collecting goes beyond a simple hobby; it can be a promising way to build wealth. Coins generally fall into three main categories:

Bullion Coins: Made from precious metals such as gold and silver, their value is based primarily on the metal content. For example, a one-ounce gold coin often reflects the current gold market price, which can fluctuate significantly—recently hovering around $4,500 per ounce.

Numismatic Coins: These are valued for their rarity, condition, and demand. For instance, a rare 1930 penny can sell for over $18,000, depending on its condition and collector interest.

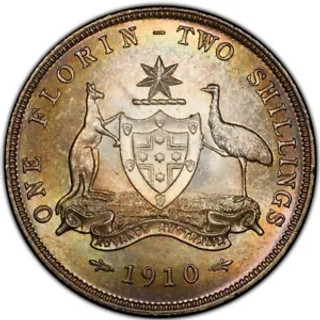

Collectible Coins: These coins appeal to enthusiasts for their unique designs and historical significance. A classic example is the 1993 Australian 50 Cents, which, due to its popularity and limited availability, can command values much higher than face value.

Research various coins, their history, and their market liquidity to make informed decisions. Your understanding will directly influence your investment strategy.

Setting Your Investment Goals

Before purchasing coins, it's essential to define your investment goals. Are you aiming for quick profits, or do you prefer long-term growth? Clear objectives guide decision-making and help manage risks.

Ask yourself these questions:

What time frame do I expect for returns?

How much risk am I willing to take?

Am I interested in particular types of coins or collecting areas?

After answering these, you can build a tailored portfolio according to your needs.

Diversification: The Key to Risk Management

Diversification is a vital aspect of a well-structured coin portfolio. Depending on a single type of coin can expose you to significant risks. A robust portfolio combines various types of coins, including:

Bullion Coins: Their value is tied to the price of precious metals, making them a stable investment choice.

Numismatic Coins: While these have the potential for higher returns, they require more knowledge to assess their real worth.

Collectible Coins: Their value largely depends on demand and rarity, often providing excellent long-term appreciation.

For example, if you allocate 50% of your investment into bullion coins, 30% into numismatic coins, and 20% into collectibles, you create a balanced strategy that can weather market changes better than investing heavily in one category alone.

Researching and Evaluating Coins

The coin market is always changing, influenced by trends, collector emotions, and market forces. Continuous research enhances sustainability and growth of your portfolio. Key evaluation methods include:

Market Trends: Following current trends is critical. For instance, during 2020, demand for silver coins surged by over 200%, largely due to heightened interest in precious metals as safe havens.

Professional Grading: Understanding coin grading is essential for determining value. Certified coins from reputable grading organizations sell at 10-30% higher prices than ungraded coins, making this an important factor in your evaluation.

Historical Significance: Coins with historical value tend to increase in demand and appreciation. For example, a coin from an important historical event can attract collectors for decades.

Thoroughly researching coins and evaluating them against these criteria will strengthen your portfolio's quality.

Establishing a Budget

A well-defined budget is vital for navigating the coin market effectively. Determine how much you are willing to invest based on your financial situation and goals.

Allocate your budget carefully by considering:

Initial Investments: Define how much you will spend to acquire coins initially.

Reinvestment: Set aside a portion of your profits for future purchases, fostering portfolio growth.

Maintenance Costs: Don't forget to factor in expenses for storage, insurance, and grading fees, which can accumulate and impact your returns.

Being disciplined with your budget helps you weather the inevitable market fluctuations and avoid impulsive decisions.

Maintaining Your Portfolio

Once your portfolio is established, it's important to monitor and maintain it for continued success. Regular assessments enable you to adapt to market changes and make informed adjustments.

Keep these points in mind:

Routine Valuations: Regularly evaluate the market value of your portfolio to align with your financial plans. For example, if your portfolio appreciates by 15% annually, it's essential to reassess every three to six months.

Market Research: Stay knowledgeable about market dynamics, and adjust your portfolio as needed based on newfound insights.

Tax Implications: Understand how taxes affect your investment returns. Consulting with a tax advisor ensures you're making informed decisions that maximize gains.

Proactive management of your portfolio optimizes its performance and return potential.

Final Thoughts

Building a successful coin portfolio is both art and science. By grasping the basics of coin investment, setting clear objectives, diversifying your holdings, conducting thorough research, and maintaining your portfolio, you'll create a collection that is both enjoyable and profitable.

Patience and diligence are key. Continuous education about market trends and regular portfolio evaluations can help uncover new opportunities. Whether you are a beginner or a seasoned collector, these steps will guide you on the path to mastering the craft of building a diverse and lucrative coin portfolio.

Start your coin investment journey with confidence and insight. The rewards may exceed your expectations. Happy collecting!

Comments