Uncovering the Hidden Treasure: The Essential Beginner's Guide to Investing in Rare Coins

- Charlie Tripodis

- Jan 27

- 3 min read

Investing in rare coins is an adventure that captivates both seasoned investors and newcomers. The allure of holding pieces of history can be thrilling. Coins have been used for trade for thousands of years, and today, they are prized collectibles with significant value. This guide will equip you with the essential knowledge you need to navigate the vibrant world of rare coin investing. You will learn about coin grading, factors that influence value, and tips for building a varied coin collection.

Understanding Coin Grading

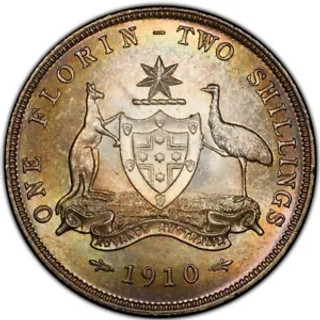

Coin grading is crucial as it directly affects a coin's value and appeal. It assigns a numerical grade to a coin based on its condition, with scores ranging from 1 (poor) to 70 (perfect) on the Sheldon scale. For example, a coin graded at 65 can be worth hundreds or even thousands of dollars, while one graded at 30 might only be worth a fraction of that amount.

Factors that determine a coin's grade include:

Surface Quality: How smooth and undamaged the surface of the coin is.

Luster: The shininess and reflective quality of the coin.

Color: The originality and vibrancy of the coin’s color.

Familiarize yourself with terms like "MS" (Mint State) and "AU" (About Uncirculated). For instance, an MS-70 coin can sell for 5 to 10 times the value of an MS-65 coin. Investing in quality pieces is essential, as even minor scratches or blemishes can dramatically lower a coin’s grade and value.

Factors Influencing Coin Value

Several key factors can significantly influence the value of rare coins:

Rarity: The fewer coins available, the higher their potential value. For example, the 1909-S V.D.B penny, which had a mintage of just 484,000, holds a value of over $1 million in top condition today.

Demand: Market demand varies. Coins like the American Silver Eagle are highly sought after, with millions sold each year, impacting their current market price.

Historical Significance: Coins tied to pivotal historical events, such as the 1861 Confederate States half dollar, have a unique allure. Collectors often pay premium prices for coins with rich stories.

Market Trends: Awareness of market conditions is vital. For instance, gold coins tend to rise in value during economic downturns, making them a safer investment during uncertain times.

Understanding these factors allows you to make informed investment choices and enhance your chances of returning profits.

Building a Diverse Coin Portfolio

Just like with standard investments, diversifying your coin collection is vital for reducing risk. Consider these strategies to help you build a well-rounded portfolio:

Invest Across Different Eras: Acquire coins from various historical periods. For example, you might invest in ancient Roman coins alongside modern U.S. coins and international currencies. This diversity exposes you to different market trends.

Include Different Types of Coins: Mix bullion coins, numismatic collectibles, vintage coins, and commemorative pieces. This strategy not only spreads risk but also maximizes potential returns.

Establish a Budget: Define a clear investment budget. For instance, if you allocate $2,000 for coin collecting, avoid exceeding this limit. Impulse buys can derail your financial goals.

Seek Expert Opinions: Connect with experienced collectors or attend coin shows. Engaging with numismatic professionals can provide invaluable insights. For example, joining a local coin club can sometimes lead to exclusive access to rare finds.

Stay Informed: The numismatic world is continually evolving. Subscribe to industry newsletters or follow market reviews. This knowledge can help you spot trends and make timely investments.

Building a diverse coin portfolio takes patience and effort, but it can bring both emotional fulfillment and financial rewards.

Embarking on Your Coin Investment Journey

As you begin your adventure in rare coin investing, keep in mind that your knowledge is one of your most valuable assets. Understanding grading, recognizing essential value factors, and developing a balanced portfolio can pave the way for success.

Investing in rare coins goes beyond merely acquiring artifacts. It is about connecting with history and appreciating the craftsmanship behind each piece. With careful research and some patience, you can discover the immense potential that this fascinating field holds.

Engage with other collectors, visit coin shows, and expand your understanding. The world of rare coins is waiting for you. Who knows? You may uncover treasures that not only enhance your investment portfolio but also offer glimpses into times gone by. Happy collecting!

Comments